Trading Update: Wednesday May 10, 2023

S&P Emini pre-open market analysis

Emini daily chart

- The Emini has had two consecutive days, with the range being less than 20 points. Bulls want follow-through buying.

- Emini连续两天涨幅都在20点以内。多头希望跟进购买

- The daily chart is in the middle of a trading range that has gone on for over a month. This means that the market is in breakout mode and deciding on the direction of the breakout.

- 日线图处于已经持续了一个多月的交易区间的中间。这意味着市场处于突破模式并决定突破的方向

- Traders should assume that the probability is close to 50% for both the bulls and the bears.

- 交易者应假设多头和空头的概率都接近 50%

- At the moment, the odds slightly favor the bulls, but not by much. If the bulls had a big advantage, the market would not go sideways.

- 目前,赔率略有利于多头,但幅度不大。如果多头有很大的优势,市场就不会横盘整理

- Since last Friday had a strong reversal up, that increases the odds that the bulls will get a second leg up to the May 1st low.

- 由于上周五出现了强劲的反转,这增加了多头再次上涨至 5 月 1 日低点的可能性

- The bulls will probably get at least a small second leg up because of the strength of the May 5th bull breakout.

- 由于 5 月 5 日牛市突破的力量,多头可能至少会在第二回合上涨

- The bears had a 4-bar bear micro channel down to May 4th. The bears that sold the May 4th high are trapped and likely sold more higher. Trading ranges are forgiving if a trader uses wide stops and scales in higher. Like the bears that sold the April 26th high and scaled in higher, the market eventually allowed those bears out.

- 截至 5 月 4 日,熊市有一个 4 栏熊市微频道。卖出 5 月 4 日高点的空头被困,可能卖出更高。如果交易者使用较宽的止损和较高的规模,则交易范围是宽容的。就像卖出 4 月 26 日高点并走高的空头一样,市场最终允许这些空头离场

- Overall, the market is in breakout mode, and it is important to realize that the probability is close to 50% for both the bulls and the bears. If one side had a high probability, the market would not go sideways. Traders who want high probability should wait and see a clear breakout with follow-through; otherwise, sideways is more likely.

- 总体而言,市场处于突破模式,重要的是要意识到多头和空头的概率都接近 50%。如果一方有很大的概率,市场就不会横盘整理。想要高概率的交易者应该观望一个明显的突破并跟进;否则,横向的可能性更大

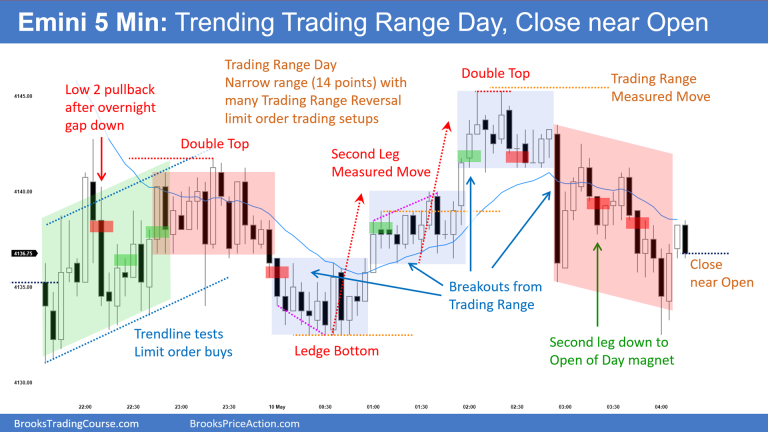

Emini 5-minute chart and what to expect today

- Emini is up 27 points in the overnight Globex session.

- The Globex Market had an upside breakout recently during the 5:30 AM PT report.

- Globex 市场最近在太平洋时间上午 5:30 的报告中出现了上行突破

- Today will probably gap up, and the Bulls will try to get a second leg up after last Friday’s bull breakout.

- 今天可能会跳空,多头将在上周五的牛市突破后尝试第二回合上涨

- As I often say, traders should expect the open to go sideways for the first 6-12 bars. However, they should be open to a possible bull trend from the open.

- 正如我经常说的,交易者应该预料到前 6-12 个柱线的开盘价会横盘整理。但是,他们应该对开盘后可能出现的牛市趋势持开放态度

- Since the odds are the market will gap up, traders should expect the bulls to get at least a second leg up. If the market sells off on the open, traders should expect the bulls to get at least an attempt up following the gap up.

- 由于市场很可能会跳空,交易员应该预计多头至少会再次上涨。如果市场在开盘时抛售,交易者应该预计多头至少会在跳空后尝试上涨

- If the buying pressure is not strong on the open, traders should expect sideways to down and for the market to try and test the moving average.

- 如果开盘时买盘压力不强,交易者应预期横向下跌,市场将尝试测试移动平均线

Emini intraday market update

- The Emini gapped up and sold off quickly down to bar 5.

- Emini 跳空并迅速抛售至 bar 5

- The selloff to bar 5 was strong enough to make the market Always In Short and increased the odds of a second leg down. However, the selloff was climactic, which increased the risk of a deep pullback.

- 抛售到 5 根柱线的力度足以使市场始终处于空头状态,并增加了第二条腿下跌的可能性。然而,抛售达到高潮,这增加了深度回调的风险

- It was reasonable to buy bar 1 following the large gap up. Any selloff was more likely to convert the market into a trading range instead of a bear trend.

- 在大幅上涨后买入 1 号柱是合理的。任何抛售都更有可能将市场转变为交易区间而不是熊市趋势

- The rally on bar 7 was strong. However, it followed a large selloff.

- 7 号柱的涨势强劲。然而,随后出现了大规模抛售

- This meant the best the bulls could expect was a trading range. While the odds favored buyers below bar 7:10 AM PT for a second leg up, the bears got a downside breakout a few bars later, a new low of the day.

- 这意味着多头可以预期的最好的是一个交易区间。虽然在太平洋时间上午 7 点 10 分柱线下方买家获得第二轮上涨的可能性较大,但空头在几个柱线后出现下行突破,创下当日新低

- As of bar 40 (9:50 AM PT), while the bears have done a good job with the selling pressure today, there has been a lot of buying pressure. This increases the risk of today not closing on its low, so traders should expect a rally back to the bar 5 low.

- 截至 40 柱(太平洋时间上午 9 点 50 分),虽然空头今天很好地应对了抛售压力,但也存在很大的买盘压力。这增加了今天未收于低点的风险,因此交易者应该期待反弹回到 5 低点

Yesterday’s Emini setups