Trading Update: Thursday April 26, 2023

S&P Emini pre-open market analysis

Emini daily chart

- The Emini sold off yesterday, closing below the past 17 bars. Yesterday’s bear breakout is a big enough surprise to lead to a 2nd leg down, probably.

- Emini 昨天抛售,收于过去的 17 个柱线下方。昨天的空头突破是一个足够大的惊喜,可能会导致第二轮下跌。

- The bears want follow-through today, and the bulls want to prevent the bears from getting follow-through.

- 空头今天想跟进,多头想阻止空头跟进。

- If the bears get a follow-through bar today similar to yesterday’s close, the market could sell off quickly back to 4,000.

- 如果空头今天获得类似于昨天收盘价的跟进柱线,市场可能会迅速抛售回 4,000 点。

- While yesterday’s bar may be a bear trap, forcing bears to sell low in what will become a trading range, the first reversal up is probably limited.

- 虽然昨天的柱线可能是一个空头陷阱,迫使空头在将成为交易区间的低位卖出,但第一个反转上涨可能是有限的。

- The first target for the bears is March 22nd high. The bears want to get a close below the March 22nd high.

- 空头的第一个目标是 3 月 22 日的高点。空头希望收盘价低于 3 月 22 日的高点。

- The bulls will try and defend the March 22nd breakout point high. They want the gap (March 22nd high) to stay open and for the market to lead to a measured move up from the March 13th high to the March 22nd high, which projects up to 4,300.

- 多头将努力捍卫 3 月 22 日的突破点高点。他们希望缺口(3 月 22 日的高点)保持开放,并让市场从 3 月 13 日的高点有节制地上涨至 3 月 22 日的高点,预计最高可达 4,300 点。

- At the moment, the upside is probably limited, and the market will probably get at least a small 2nd leg down. Traders will pay close attention to the follow-through today to see how eager the bears will be to sell after yesterday’s bear breakout.

- 目前,上行空间可能有限,市场可能至少会出现第二小段下跌。交易者将密切关注今天的后续行动,以了解在昨天的熊市突破后空头的卖出意愿有多大。

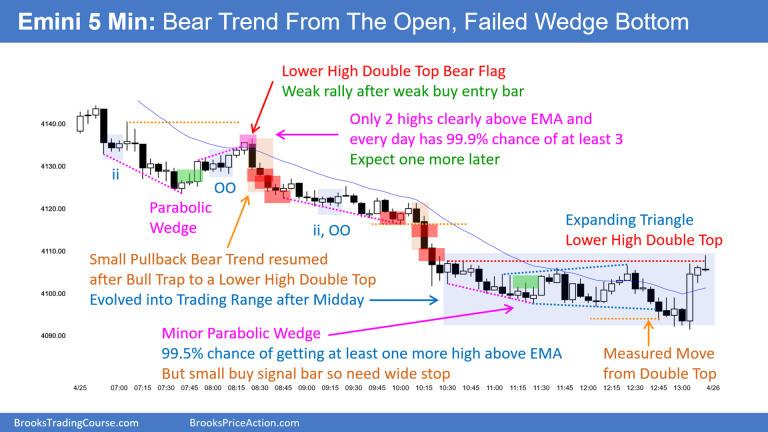

Emini 5-minute chart and what to expect today

- Emini is down 2 points in the overnight Globex session.

- The Globex market has gone sideways during the overnight hours; the U.S. session will probably have little to no gap on the open.

- Globex 市场在隔夜时间横盘整理;美国时段开盘可能几乎没有跳空。

- As I often say, traders should expect a trading range on the open and wait for 6-12 bars.

- 正如我经常说的,交易者应该在开盘时预期交易区间并等待 6-12 根柱线。

- Most traders should wait for the opening swing to develop, which typically happens after the formation of a double top/bottom or a wedge top/bottom and begins before the end of the second hour.

- 大多数交易者应该等待开盘摆动的发展,这通常发生在双顶/双底或楔形顶/底形成之后,并在第二个小时结束之前开始。

- Because of yesterday’s strong bear breakout, traders should expect today to disappoint the bears. However, traders should also be open to the possibility of a bear trend, and if the bear begins to get strong consecutive bear trend bars on the open, they cannot be in denial.

- 由于昨天的空头突破强劲,交易员应该预料到今天会让空头失望。然而,交易者也应该对熊市趋势的可能性持开放态度,如果熊市在开盘时开始出现强劲的连续熊市趋势线,他们就不能否认。

Emini intraday market update

- The Emini sold off after going sideways for the first 8 bars on the open.

- Emini 在开盘前 8 根柱线横盘整理后被抛售。

- While the selloff down to bar 12 was strong, it was a lower low major trend reversal (final flag).

- 虽然跌至 12 根柱线的抛售很强劲,但这是一个较低的低点主要趋势反转(最终旗形)。

- The rally up to 9:10 AM PT was substantial; however, it was the first major trendline break of yesterday’s strong bear trend day. This increased the odds of a deep pullback and formation of a trading range, which is what happened.

- 太平洋时间上午 9 点 10 分之前的涨势相当可观;然而,这是昨天强劲熊市趋势日的第一个主要趋势线突破。这增加了深度回调和交易区间形成的可能性,这就是发生的事情。

- As of 10:40 AM PT, the bears want the selloff to reach the low of the day. However, this is unlikely. More likely, the market is going to bounce and go sideways.

- 截至太平洋时间上午 10:40,空头希望抛售达到当天的低点。然而,这不太可能。更有可能的是,市场将反弹并横盘整理。

- Traders should pay attention to the open of the day as it will likely remain a magnet for the rest of the day.

- 交易者应注意当天的开盘,因为它可能会在一天的剩余时间内保持吸引力。

Yesterday’s Emini setups

![Jupyter-安装[Docker]](/medias/featureimages/34.jpg)